aurora co sales tax calculator

The Aurora Cd Only Colorado sales tax is 700 consisting of 290 Colorado state sales tax and 410 Aurora Cd Only local sales taxesThe local sales tax consists of a 025 county sales tax a 375 city sales tax and a 010 special district sales tax used to fund transportation districts local attractions etc. The sales tax rate for aurora was updated for the 2020 tax year.

Sales Use Tax South Dakota Department Of Revenue

Most transactions of goods or services between businesses are not subject to sales tax.

. The Minnesota sales tax rate is currently. The 2018 United States Supreme Court decision in South Dakota v. This sales tax will be remitted as part of your regular city of Aurora sales and use tax filing.

Did South Dakota v. The sales tax rate does not vary based on zip code. If the due date 20 th falls on a weekend or holiday the next business day is considered the due date.

Unlike VAT which is not imposed in the US sales tax is only enforced on retail purchases. Aurora is located within Portage County Ohio. The Colorado sales tax rate is 29 the sales tax rates in cities may differ from 325 to 104.

Wayfair Inc affect Colorado. Commerce City 12 miles Denver 13 miles. 24 lower than the maximum sales tax in CO The 85 sales tax rate in Aurora consists of 29 Colorado state sales tax 075 Adams County sales tax 375 Aurora tax and 11 Special tax.

Aurora is in the following zip codes. Sales Tax State Local Sales Tax on Food. Within Aurora there is 1 zip code with the most populous zip code being 44202.

Aurora CO Sales Tax Rate The current total local sales tax rate in Aurora CO is 8000. Aurora has parts of it located within Adams County and Arapahoe County. Sales Tax Breakdown Aurora Details Aurora CO is in Arapahoe County.

The december 2020 total local sales tax rate was also 8000. The average sales tax rate in Colorado is 6078. Wayfair Inc affect Minnesota.

There is no county sale tax for aurora west virginiathere is no city sale tax for aurora. There is no city sale tax for aurora. This includes the rates on the state county city and special levels.

Ad Lookup Sales Tax Rates For Free. Puerto Rico has a 105 sales tax and Aurora County collects an additional NA so the minimum sales tax rate in Aurora County is 45 not including any city or special district taxesThis table shows the total sales tax rates for all cities and towns in Aurora. Aurora OR Sales Tax Rate Aurora OR Sales Tax Rate The current total local sales tax rate in Aurora OR is 0000.

The average cumulative sales tax rate in Aurora Colorado is 804. Ad Automate Standardize Taxability on Sales and Purchase Transactions. RE trans fee on median home over 13 yrs Auto sales taxes amortized over 6 years Annual Vehicle Property Taxes on 25K Car.

This includes the rates on the state county city and special levels. Aurora in Colorado has a tax rate of 8 for 2022 this includes the Colorado Sales Tax Rate of 29 and Local Sales Tax Rates in Aurora totaling 51. The Aurora Colorado sales tax is 850 consisting of 290 Colorado state sales tax and 560 Aurora local sales taxesThe local sales tax consists of a 075 county sales tax a 375 city sales tax and a 110 special district sales tax used to fund transportation districts local attractions etc.

Quarterly if taxable sales are 4801 to 95999 per year if the tax is less than 300 per month. As we all know there are different sales tax rates from state to city to your area and everything combined is the required tax rate. Real property tax on median home.

4049 S Himalaya Cir Aurora CO 80013 575000 MLS 8926759 Welcome to this beyond lovely home. Interactive Tax Map Unlimited Use. Method to calculate Aurora sales tax in 2021 As we all know there are different sales tax rates from state to city to your area and everything combined is the required tax rate.

The minimum combined 2022 sales tax rate for Aurora Colorado is. Sales Tax Breakdown Aurora Details Aurora OR is in Marion County. See how we can help improve your knowledge of Math.

One of a suite of free online calculators provided by the team at iCalculator. If the vehicle is purchased from a dealer in colorado the dealer will collect the state sales tax and remit it to the state. The December 2020 total local sales tax rate was also 0000.

The sales tax rate ranges from 0 to 16 depending on the state and the type of good or service and all states differ in their enforcement of sales tax. How 2021 q2 sales taxes are calculated in aurora. The minimum combined 2022 sales tax rate for Aurora Minnesota is.

You can print a 85 sales tax table here. The Colorado sales tax rate is 29 the sales tax rates in cities may differ from 325 to 104. The Aurora sales tax rate is.

Integrate Vertex seamlessly to the systems you already use. The Aurora sales tax rate is. The Colorado sales tax rate is currently.

Historical Sales Tax Rates for Aurora. Within Aurora there are around 17 zip codes with the most populous zip code being 80013. For tax rates in other cities see Colorado sales taxes by city and county.

Business Licensing and Tax Class. Situated in an ideal setting directly across the str. The minimum combined 2021 sales tax rate for aurora colorado is 8.

The colorado sales tax rate is currently 29. 4 beds 3 baths 2104 sq. The aurora colorado general sales tax rate is 29depending on the zipcode the sales tax rate of aurora may vary from 675 to 85 every 2021 combined rates mentioned above are the results of colorado state rate 29 the county rate 025 to 075 the aurora tax rate 25 to 375 and in some case special rate 01.

The Aurora Colorado Sales Tax Comparison Calculator allows you to compare Sales Tax between all locations in Aurora Colorado in the USA using average Sales Tax Rates andor specific Tax Rates by locality within Aurora Colorado. Places Near Aurora CO with Sales Tax Calculator. Did South Dakota v.

Retailers are required to collect the Aurora sales tax rate of 375 on cigarettes beginning Dec. Annually if taxable sales are 4800 or less per year if the tax is less than 15 per month. See reviews photos directions phone numbers and more for Sales Tax Calculator locations in Aurora CO.

The December 2020 total local sales tax rate was also 8000. Sales Tax Summary The average cumulative sales tax rate in Aurora Ohio is 7. The aurora colorado general sales tax rate is 29depending on the zipcode the sales tax rate of aurora may vary from 675 to 85 every 2021 combined rates mentioned above are the results of colorado state rate 29 the county rate 025 to 075 the aurora tax rate 25 to 375 and in some case special rate 01.

Aurora Sales Tax Calculator. The average sales tax rate in Colorado is 6078. File Aurora Taxes Online.

Note that failure to collect the sales tax does not remove the retailers responsibility for payment. The County sales tax rate is. This is the total of state county and city sales tax rates.

80010 80011 80012. For sale 231 IVY JAY CRES Aurora Ontario L4G0E7 from wwwrealtorca. The County sales tax rate is.

This is the total of state county and city sales tax rates. The total sales tax rate in any given location can be broken down into state county city and special district rates. Method to calculate Arapahoe County sales tax in 2021.

See reviews photos directions phone numbers and more for Sales Tax Calculator locations in Aurora CO.

Sales Tax Revenue In Colorado Cities Since Start Of The Pandemic Common Sense Institute

80016 Sales Tax Rate Co Sales Taxes By Zip

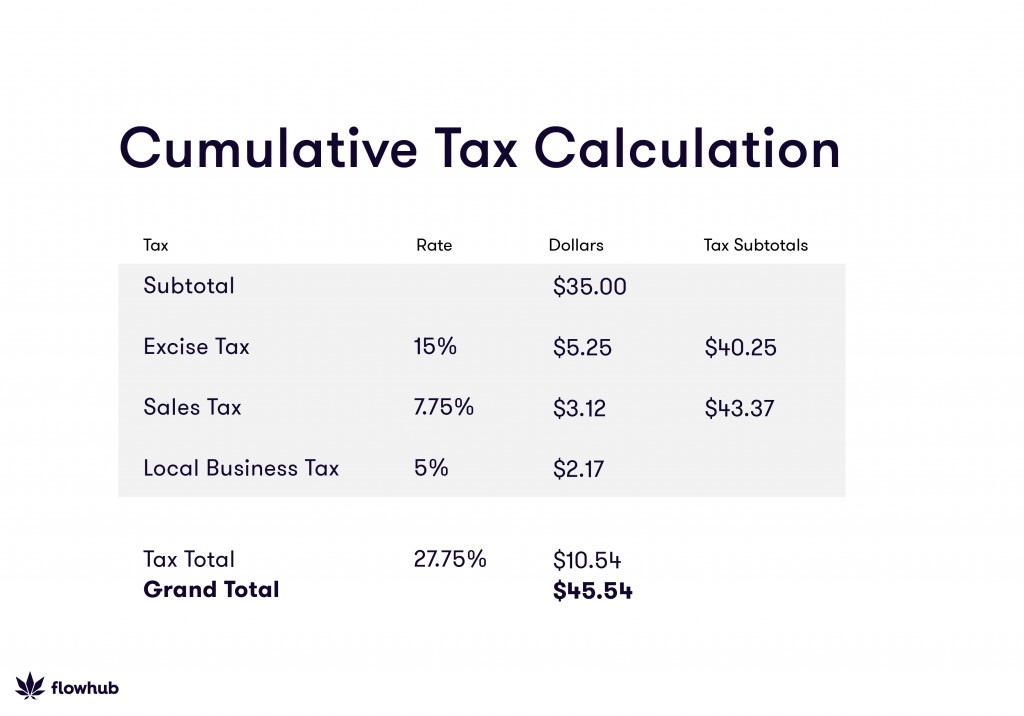

How To Calculate Cannabis Taxes At Your Dispensary

How Colorado Taxes Work Auto Dealers Dealr Tax

How To Pay Sales Tax For Small Business 6 Step Guide Chart

Capital Gains Tax Calculator 2022 Casaplorer

Are Denver Taxes Too High The Fiscal Impacts Of Ordinance 304 Enough Taxes Already Common Sense Institute

Illinois Car Sales Tax Countryside Autobarn Volkswagen

The Income Tax Rate In Colorado Is 4 63 This Is Not The Only Tax You Will Pay On Your Earnings

How Amazon Charges Sales Tax On Colorado Purchases The Denver Post

How To Use Tax Function On Calculator Youtube

Are Denver Taxes Too High The Fiscal Impacts Of Ordinance 304 Enough Taxes Already Common Sense Institute

Set Up Automated Sales Tax Center

How To Calculate Cannabis Taxes At Your Dispensary

Colorado Vehicle Sales Tax Fees Calculator Find The Best Car Price

Colorado Sales Tax Guide And Calculator 2022 Taxjar

How Colorado Taxes Work Auto Dealers Dealr Tax

How Colorado Taxes Work Auto Dealers Dealr Tax

Ten Year Trend Shows Increase In Effective Property Tax Rates For Collar County Communities The Civic Federation